Table of Content

County Treasurers, land contract holders, mobile home lenders. The U.S. Department of the Treasury notified MSHDA on April 14, 2021 that it will allocate $242,812,277 to the State of Michigan. This number was based on unemployed individuals and the number of mortgagors with delinquent mortgage payments. Second, you will need to pay back the down payment assistance if you choose to refinance your MSHDA loan. In some cases, there may be a small fee to attend a homebuyer education class.

They may have taken advantage of a special program MSHDA was offering. In 2018, MSHDA rolled out a program where they gave buyers $15,000 in down payment assistance and every year they owned the home 20 percent of the DPA would be forgiven. The $10,000 down payment assistance is only available with the MI Home Loan in 236 qualifying zip codes. I think it’s because of a misunderstanding of the program.

Popular on michigan.gov

MSHDA administers the largest statewide HCV program in the nation through a unique partnership with Civil Servant employees and third-party independent contractors known as Housing Agents. Program participants may select the unit of their choice ranging from single family homes to units within multifamily developments. The Michigan State Housing Development Authority offers Down Payment Assistance to specifically help repeat homebuyers purchase a home. The assistance is provided with a zero-interest, non-amortizing loan with no monthly payments. To qualify for the loan, you need to take a Michigan homebuyer education class.

Or, you could find yourself in a negative equity position if home values drop. So, for example, if you’re purchasing a home for $150,000, then you need to be able to bring $1,500 to the closing table as down payment. So, someone who owned a home five years ago will qualify for the program.

MI Home Loan Vs. Flex Program

This can help borrowers with less than perfect credit get a low interest rate. So, you would have to come up with the cash to pay off the down payment loan before you can refinance. Failure to come up with the difference will hold you back from refinancing a MSHDA loan. To be eligible for a refinance on the mortgage, you need to pay the down payment assistance back. A lender will not allow you to refinance the down payment assistance.

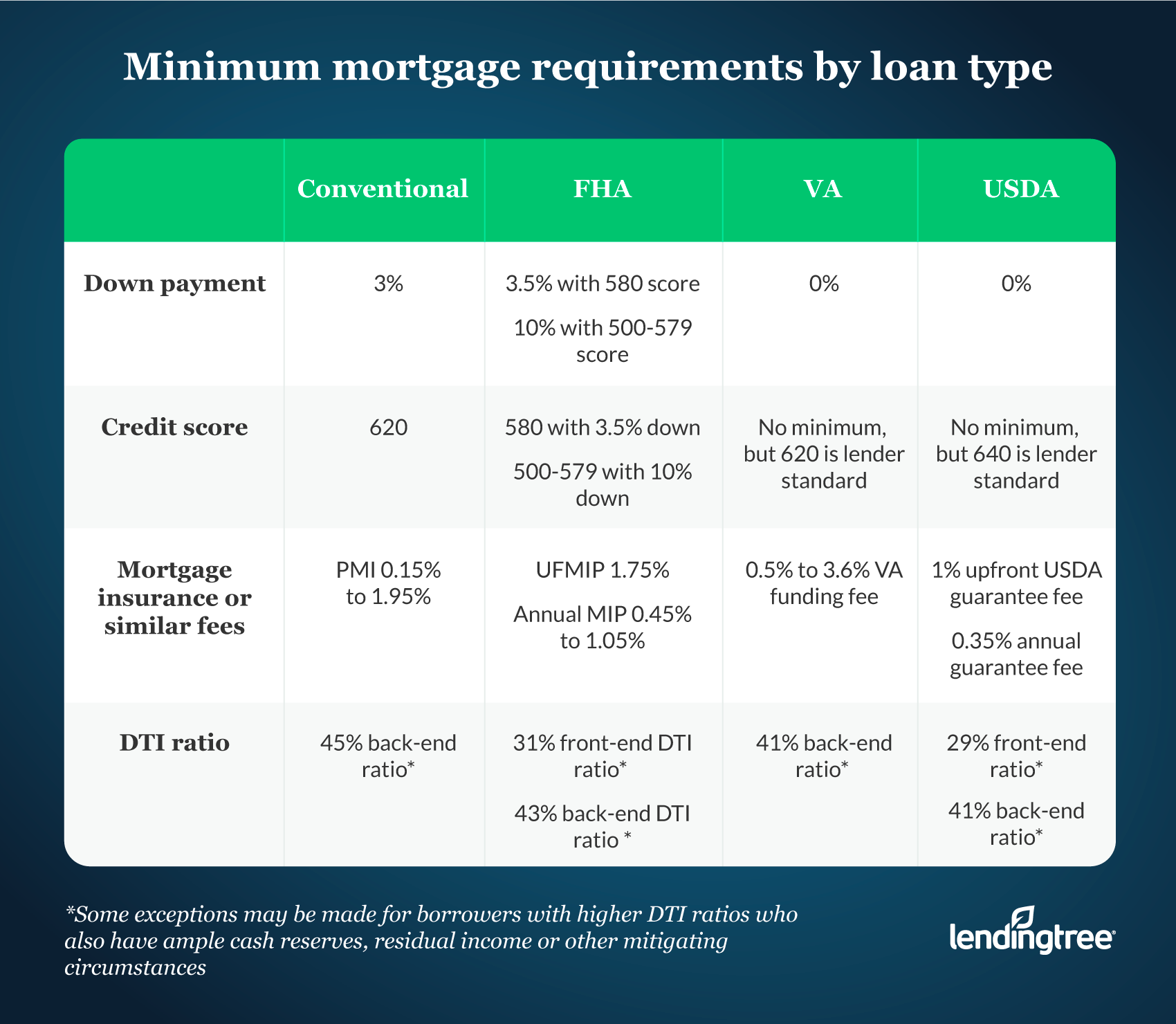

The Michigan State Housing Development Authority or MSHDA program has two basic options for home buyers. The first is a down payment assistance program available to home buyers in Michigan. The second is a program that offers a significantly reduced interest rate. The easiest way to explain this program is that its an add on to an FHA, Conventional, or Rural Development loan.

MI State Housing Development Authority

Please update to a modern browser such as Chrome, Firefox or Edge to experience all features Michigan.gov has to offer. Go to Neighborhood Enhancement The NEP program provides MSHDA funding statewide for activities directly tied to stabilization and enhancement of Michigan neighborhoods by nonprofit 5013 agencies. Go to Resources & Related Links State and national links to homeless and special housing needs information. With any home loan product, it is crucial to have the most accurate and current data to ensure quality pricing and service. • Applications for all MSHDA Homeownership programs made on or after June 8 will require full interior/exterior appraisals.

Down payment assistance programs and/or grants were researched by the team at FHA.com. Please note that all programs listed on this website may involve a second mortgage with payments that are forgiven, deferred, or subsidized in some manner until resale of the mortgaged property. One of the programs that MSHDA offers is the MI First Home Down Payment Assistance . This down payment assistance is a zero-interest, non-amortizing loan with no monthly payments. MSHDA’s Homeownership division provides a variety of programs and products for both homebuyers and homeowners. We can help if you’re trying to purchase a home, improve your current property or are facing foreclosure.

November Lunch and Learn / Webinar: Low Down Payment Options For Home Buyers

Borrowers receive a Federal tax credit for 20% of the mortgage interest they paid the previous year. Available to first time buyers only unless the home is in a “targeted” area. Is now available to help organizations inform and engage eligible homeowners. This toolkit includes flyers, FAQ information, social media content for Facebook, Twitter, and LinkedIn, along with other resources for effective marketing campaigns to reach those in need. All MIHAF applications will be reviewed and determined eligible on a first come, first serve basis.

Of course, there are cases where you need to refinance due to things like divorce. Given the 50 percent divorce rate, you may need to refinance your MSHDA loan. Lastly, and not common, is you will need to pay back the MSHDA down payment loan when you go to pay your home off in full. You can find a free credit score on sites like CreditKarma or Credit Sesame. These sites will often have recommendations for you on how to improve your credit score. Home buyers with FHA loans or USDA loans can be at just as much risk.

You can find these classes through your lender or by looking on MSHDA’s website. I don’t recommend trying to Google things like First time home buyer education class. You will need to register, attend and get a certificate of completion for a homebuyer education class. The certificate will need to be submitted to your lender. Your lender will then submit your certificate to MSHDA along with the entire lending package.

With Covid, you can find these classes in multiple formats — online and in-person. Our partnership with one of Michigan’s top MSHDA lenders allows us to help home buyers get connected and qualified for MSHDA loans. For example, if you sell your home or refinance your mortgage, the down payment assistance will need to be paid back. To be able to buy a home with the MSHDA program and provide a safe, stable environment for her daughter brought her to tears.

It is up to the consumer to contact these entities and find out the specifics of each program. The most recognized 3.5% down payment mortgage in the country. This program lets buyers get a single loan with just one closing. That depends on your financial and personal circumstances. MI Home Flex is a little more flexible and only requires one adult to apply (i.e. one partner out of a couple).

So, ask your lender before taking a class and prior to paying any money for the education class. The education class must be provided by a HUD-approved housing counseling agency. There are a lot of scams out there offering a home buyer education class.

In the case of $7,500 in down payment assistance funds that would leave $2,500 in the MSHDA pot of money that could be used towards closing costs. Meet household income limits based on area and household size. Lower monthly PMI rate than a standard conventional loan. Standard FHA and RD mortgage insurance rates are not affected. The down payment assistance is repaid when the home is sold or the mortgage is refinanced.

The down payment assistance program helps cover many of the upfront costs of homeownership. The biggest benefit to a MSHDA loan is that it provides opportunity for homeownership where it might not otherwise be possible, due to the large barrier of saving up enough money for a down payment. Meaning, home buyers can purchase a home with very little money down. The MSHDA program only requires you to provide at least one percent of the total loan amount. The primary benefit to a MSHDA loan is the down payment assistance program , which gives people an opportunity to purchase a home without all of the typical upfront cash.

No comments:

Post a Comment